Demography and the Great Bull Market Ahead

Demography is destiny!

As always: Demography is destiny!

And that’s great to hear, since demography is now on our side to the greatest extent in 35 years.

In 1982, the greatest secular bull market in history began, and a big factor driving it was the maturing of the enormous Baby Boom generation. Over the next 18 years, the stock market rose over 1,100 percent. And, we’re about to see another economic boom that will be just as big. How do we know? In addition to the obvious technological and behavioral factors, we’ve reached a crucial demographic milestone. In 2017, the oldest members of the enormous Millennial generation will be the same age the oldest Boomers were in 1982.

Even better, this time we don’t have to wait for Reagan and Volker to do the painful work of killing inflation. Everything is in place for takeoff; we just need to light the fuse.

Based on our analysis, we can expect to see one of the biggest long-term economic upswings in history, rivaled only by the post-World War II boom that ran from the late 1940s through the “soaring ‘60s.” And this era of rising prosperity should last at least into the late 2030s.

Whether they’re in marketing, finance, or public policy, most professionals are familiar with the various generational cohorts of the 20th century:

- The so-called Greatest Generation, born 1910 to 1927, fought World War II; it includes John F. Kennedy and Ronald Reagan.

- The Silent Generation, born 1928 to 1945, fought the Korean War; it includes Jack Welch and Elvis Presley.

- The Baby Boom Generation, born 1946 to 1964, fought the Vietnam War; it includes Steve Jobs and Bill Clinton.

- Generation X, born 1965 to 1981, fought the 1991 Gulf War; it includes Michael Dell and Elon Musk.

- The Millennial Generation, born 1982 to 1999, fought the wars in Iraq and Afghanistan. It includes Mark Zuckerberg and Paris Hilton.

- Generation Z, born 2000 to 2017, includes young people just emerging as workers and consumers.Each generation not only shapes the economy and society, but also is shaped by their experiences in the economy and society. Furthermore, each generation exhibits both cohort characteristics and life-cycle characteristics.

Cohort characteristics are attributes that do not change over time. Examples include the conformity of the Silent Generation or the individualism of the Boomers. These cohort characteristics are what we typically focus on when we talk about how selling to Millennial adolescents was different from selling to Xer adolescents.

On the other hand, life-cycle characteristics are attributes that change as a generation moves from one stage of life to another. And the resulting behavioral “generation wave” plays an enormous role in determining what people do as consumers, workers, investors, and citizens, at any point in their lives.

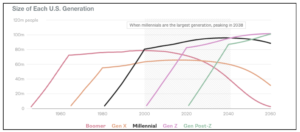

The impact that a given generation has on the economy and society depends largely on the relative size of the generation. The Greatest Generation, the Baby Boomers, and the Millennial Generation are all relatively large. The Silent Generation and Gen X are relatively small, while Gen Z is about 1 million members larger than the Millennials.

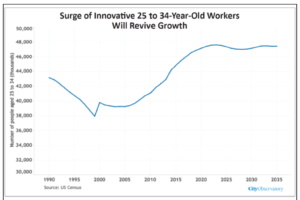

At the root of the coming economic boom is the maturing of the Millennial Generation. It’s the largest generation in U.S. history and it is just now beginning to make an major impact on growth and innovation. As the Millennials reach full productivity, the economy will take off to new heights.

Every generation follows a pattern that’s referred to as a generation wave.

The generation wave consists of four components: the birth wave, the innovation wave, the spending wave, and the organizational wave.

- The birth wave tells us when the members of a generation were born. The other waves follow at predetermined amounts of time, which means that we can reliably predict how and when the other three curves will influence the economy.

- The innovation wave dictates when a generation will introduce new innovations and concepts. This happens when the generation is entering the workforce. The Greatest Generation invented the mainframe computer. The Silent Generation gave us the minicomputer. The Baby Boom Generation invented the microcomputer. Gen X built the World Wide Web. Millennials invented smartphone apps, launched social media, and seem poised to make AI a transformative industry.

- The spending wave indicates the timing of spending activity by each generation. At specific ages, people can be counted on to buy specific products and spend at specific levels, on average. The timing for purchases of cars, houses, children’s college tuition, and other items are surprisingly predictable. With 70 percent of GDP depending on consumption, demand is critical.

- Finally, the organizational cycle plots a timetable for the transition of power from one generation to another. In business, Boomers now dominate the C-suite, but Gen X is well represented. In government, the Greatest Generation held power in the United States from John F. Kennedy to George H.W. Bush. Boomers have held power from Bill Clinton through at least Donald Trump.

The Generation Wave idea was originally put forward by historians Neil Howe and William Strauss in their landmark book, Generations. It was subsequently refined and extended by Harry Dent in his various books. Dent’s 1993 volume titled The Great Boom Ahead was truly prescient and provided managers with superb guidance throughout the 1990s.

However, Dent’s subsequent forecasts were less useful because of his apparent reliance on the generation wave to the exclusion of other inputs. Through our research we have discovered that although the generation wave is a crucial component of solid economic forecasting, it’s just one of several tools that we rely upon.

To put it succinctly, “Every facet of human life depends on the interaction among three important factors: technology, human behavior and demography.”

- First, technology essentially is a matter of applying scientific understanding to meeting human needs. In the January 2017 issue of our sister-publication, Trends, we explained that artificial intelligence is not simply contributing to productivity like ordinary automation; it is also creating a whole new kind of productivity enhancement by doing things that no people or machine could ever do before. And we showed why this could realistically drive average U.S. GDP growth to 4.6 percent per year in the coming decade.

- Second, human behavior is driven not only by psychology, but also by beliefs, rules, and customs that determine how we identify human needs and how technology is applied to meeting those needs. Combined with new technologies, a grasp of human behavior enables the kinds of institutional change required to fully realize the potential of each techno-economic revolution. One-size-fits-all regulation, organized labor, the public school monopoly, and indiscriminate litigation are all institutions designed for the Mass Production paradigm. So, creative destruction is quickly sweeping them away to optimize for the Digital Revolution.

- Third, demography is a product of “who we are.” It includes factors like age, gender, education, geographic location, population size, and density. Because it forecasts shifts in a generation’s life-cycle characteristics, the generation wave is an indispensable tool that lets us understand the role that demography plays in driving economic events.

So what’s the bottom line?

This year, the oldest Millennials will be 36 and the youngest will be 18. They are still building their skills and finding their career focus. They are bringing new ideas, concepts, and values to society and to the workplace. As such, this enormous generation promises to create a surge of activity that we haven’t seen since the 1980s.

Given this demographic trend, $1 million invested in an S&P 500 fund in 2017 will grow to over $6 million by 2037. That’s a big win, but it’s still less than the percentage gain we saw between 1982 and 2000. According to research by the McKinsey Global Institute, the bull market of the 80s and 90s involved a one-time expansion of multiples that will not be seen again. Fortunately, the returns of a S&P 500 index fund represent the base case for “smart investors”.

While past returns is no guarantee of future results, it is likely that the three SWA strategies will do far better.