Here’s a strategy that’s currently trouncing the indexes

Pare-5 Continues to Outperform

In the September 2016 issue of Strategic Wealth Advisor, I introduced an approach I started using in the past year. It’s called the PARE-5 strategy.

As you know, the three SWA strategies performed extremely well over the ten years from 2005 through 2014. Not only did they produce market-beating gross returns, but they also let you minimize taxes and transaction costs, while spending a minimal amount of time..

Unfortunately, market conditions that emerged beginning in mid-2014 have not favored an approach based on value and momentum. For instance, YTD 2016 the three SWA strategies have produced a total return of 6.89 percent compared to 9.4 percent for the S&P 500. As we explained previously, every strategy inevitably under-performed at some period in its history; for instance, SWA beat the S&P 500 in ten of the past twelve months. And, research shows that it’s typically smart to stick with a proven strategy during these periods, unless there has been a fundamental permanent change in the markets.

As we searched for an alternative that was working in the current environment, we developed an approach called PARE-5. PARE-5 stands for “5 Percent Positive Analyst Revision of Earnings

How does it work?

As every investor knows, the market is forward-looking. Security prices are The PARE-5 strategy screens for companies that have had at least a 5 percent increase in annual earnings estimates over the last month. Here are the criteria:

- There are more than four analysts providing earnings estimates for the current fiscal year. •

- The latest earnings per share estimate for the current fiscal year has been revised upward in the last month.

- The latest earnings per share estimate for the next fiscal year is greater than it was one month ago.

- There has been at least one revision up-ward by 5 percent or more in the earnings estimate for the current fiscal year over the last month.

- There have been no downward revisions in the earnings estimate for the current fiscal year over the last month.

- There has been at least one upward revision in the earnings estimate for the next fiscal year over the last month.

- There have been no downward revisions in the earnings estimate for the next fiscal year over the last month. From the stocks meeting all the preceding criteria, the stock is among the

- 25 stocks with the greatest increase in earnings per share estimates for the current fiscal year, in the last month. The number can be fewer than 25, but never greater.

Unlike the three Strategic Wealth Advisor strategies (Premier, Shareholder Yield, and Core Growth), PARE-5 takes a lot of time and effort to execute. You’ll also incur much higher trading costs for this high-turnover strategy if you pay on a trade-by-trade basis. Furthermore, because the portfolios turn-over at a rate of roughly 100 percent a month, rather than less than once a year, the sizeable gains represent “ordinary income” rather than “long-term capital gains.”

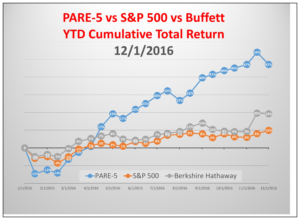

Does it work? YTD through September 30, 2016, PARE-5 produced a total return of roughly 47 percent, compared to 10 percent for the S&P 500, and 19 percent for Warren Buffett’s Berkshire-Hathaway.

IMPLEMENTING PARE-5

Unlike the three Strategic Wealth Advisor strategies (Premier, Shareholder Yield, and Core Growth), PARE-5 takes a lot of time and effort to execute. You’ll also incur much higher trading costs for this high-turnover strategy if you pay on a trade-by-trade basis. Furthermore, because the portfolios turn-over at a rate of roughly 100 percent a month, rather than less than once a year, the sizeable gains represent ordinary income rather than long-term capital gains. What does this mean? First, if you want to put PARE-5 to work for yourself, it may make sense to find a broker who will do all the work for you for a fixed fee. That includes tracking the analyst estimates, screening the stocks, and rebalancing the accounts five-to-eight times per month. For PARE-5, our broker handles everything and charges us a flat fee.

Second, while PARE-5 has absolutely trounced the three SWA strategies as well as the S&P 500 index over the past two years, this advantage is somewhat diminished over the long-term assuming the money is held in a taxable account. For that reason, much of the money we’ve in-vested in PARE-5 resides in 401K and IRA accounts; long-term, the tax advantages of the three SWA strategies can still make them appealing for accounts that are not tax-advantaged. Give It a Try This Month.

Since PARE-5 requires multiple weekly up-dates and tends to generate large profits quickly, we decided to offer it to Strategic Wealth Advisor subscribers as an add-on subscription for $99 per month. If you want to get the benefits of PARE-5 with minimal effort and fees, call my office at (800) 776-1910. They’ll give you contact information on how you can execute the strategy with minimal hassle and cost.