The Active Investor’s Solution for a Tough Market

The Amazingly Effective PARE-5 Strategy

As discussed earlier in this issue, the U. S. equities market is still solid. There is little reason to heed cries of panic from doomsayers.

In spite of this, the three historically market-beating SWA strategies have underperformed in 2015 and YTD 2016. As we explained, no strategy out-performs in every time period.

That doesn’t make you feel better in the short-term, but it explains why “staying the course” is usually the best approach.

However, it also raises the question of, “Which long-term proven strategies are working now?”

Over the past two years, the Strategic Wealth Advisor team has kept our “old money” in the three SWA strategies, but we’ve been using “new contributions” to experiment with alternative strategies.

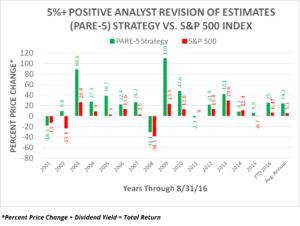

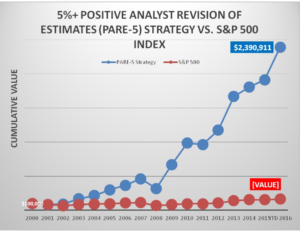

In the course of that work, we’ve uncovered a strategy with an extraordinary fifteen-year track record that has continued to dramatically outperform the total return of the S&P 500 index in YTD 2016. Specifically, YTD through 8/31/16, the S&P 500 total return was up 8.05 percent (6.5 percent excluding dividends) and the three SWA strategies were down a net of 2.9 percent. Meanwhile the so-called PARE-5 strategy was up a whopping 25.0 percent. More significantly, PARE-5 has generated an average annual return of 24.2 percent since January 2001, while the S&P 500 averaged just 5.3 percent annually. Excluding dividends, $100,000 invested in the PARE-5 strategy on January 1, 2001 would have been worth roughly $2.4 million by August 31, 2016, after expenses.

PARE-5 stands for “5 Percent Positive Analyst Revision of Earnings”.

How does it work?

As every investor knows, the market is forward-looking. Security prices are established through expectations, and prices change as these expectations change or are proven incorrect. Services such as Thomson Reuters I/B/E/S, S&P Capital IQ, and Zacks provide consensus earnings estimates by tracking the estimates of thousands of investment analysts. As we’ll explain, vigilantly tracking these estimates and their changes can be a highly rewarding strategy for stock investors.

Earnings Surprises

In using earnings estimates, the first rule to keep in mind is that the current price usually reflects the consensus earnings estimate. It is common to see price declines for stocks that report earnings increases from the previous reporting period because in many cases, while the actual earnings represent an increase, the increase is not as great as the market had expected. Earnings surprises occur when a company reports actual earnings that differ from consensus earnings estimates.

Listed companies are required to file quarterly reports to the Securities and Exchange Commission (SEC) within forty-five days of the fiscal quarter end. Most companies announce earnings approximately one month after the end of the quarter. During the earnings reporting season, financial newspapers and websites provide daily reports on earnings announcements. Firms with significant earnings surprises are often highlighted. Positive earnings surprises occur when actual reported earnings are significantly above the forecasted earnings per share. Negative earnings surprises occur when reported earnings per share are significantly below the earnings expectations. The stock prices of firms with significant positive earnings surprises show above average performance, while those with negative surprises have below average performance.

Changes in stock price resulting from an earnings surprise can be felt immediately, and the surprise also has a long-term effect. Studies indicate that the effect can persist for as long as a year after the announcement. This means that it does not make sense to buy a stock after the initial price decline of a negative earnings surprise. There is a good chance that the stock will continue to underperform the market for some time. It also indicates that it may not be too late to buy into an attractive company after a better than expected earnings report is released.

Not surprisingly, large firms tend to adjust to surprises more quickly than small firms do. Larger firms are tracked by more analysts as well as portfolio managers, who tend to act quickly.

Firms with a significant quarterly earnings surprise also often have earnings surprises in subsequent quarters. When a firm has a surprise, it often is a sign that other similar surprises will follow. This is sometimes referred to as the “cockroach effect”; like cockroaches, you rarely see just one earnings surprise.

Since both positive and negative earnings surprises have lingering long-term effects, a rewarding investment strategy is one that avoids stocks you believe will have negative earnings surprises or that have had negative earnings surprises. Selecting positive earnings surprise stocks before and even after the earnings come in may be similarly profitable. Even a strategy of simply selling after negative earnings surprises and buying after positive earnings surprises probably has some merit.

Upward Revisions

Revisions to earnings estimates lead to price adjustments similar to earnings surprises. The PARE-5 strategy relies upon tracking analysts’ earnings revisions. When earnings estimates are revised significantly upward, which we define as 5 percent or more, stocks tend to show above-average performance.

On the other hand, stock prices of firms with downward revisions tend to show below-average performance after the adjustment.

Changes in estimates reflect changes in expectations of future performance. Perhaps the economic outlook is better than previously expected, or maybe a new product is selling better than anticipated.

Revisions are often precursors to earnings surprises. As the reporting period approaches, estimates normally converge toward the consensus. A flurry of revisions near the reporting period can indicate that analysts missed the mark and are scrambling to improve their estimates.

Companies like to report positive earnings surprises, so it is not surprising that many companies try to "manage" the estimates slightly downward to create a positive surprise. Studies show that, on average, there are more positive quarterly surprises than there are negative surprises. Interestingly, estimates for the fiscal year do not tend to show the same positive surprise bias as the quarterly estimates.

Screening for Revisions

The PARE-5 strategy screens for companies that have had at least a 5% increase in annual earnings estimates over the last month. Here are the criteria:

- There are more than four analysts providing earnings estimates for the current fiscal year

- The latest earnings per share estimate for the current fiscal year has been revised upward in the last month

- The latest earnings per share estimate for the next fiscal year is greater than it was one month ago

- There has been at least one revision upward by 5% or more in the earnings estimate for the current fiscal year over the last month

- There have been no downward revisions in the earnings estimate for the current fiscal year over the last month

- There has been at least one upward revision in the earnings estimate for the next fiscal year over the last month

- There have been no downward revisions in the earnings estimate for the next fiscal year over the last month

- From the stocks meeting all the preceding criteria, the stock is among the 25 stocks with the greatest increase in earnings per share estimates for the current fiscal year, in the last month.

Implementing PARE-5

Unlike the three Strategic Wealth Advisor strategies (Premier, Shareholder Yield, and Core Growth), PARE-5 takes a lot of time and effort to execute. You’ll also incur much higher trading costs for this high-turnover strategy if you pay on a trade-by-trade basis. Furthermore, because the portfolios turn-over at a rate of roughly 100 percent a month, rather than less than once a year, the sizeable gains represent “ordinary income” rather than “long-term capital gains.”

What does this mean?

First, if you want to put PARE-5 to work for yourself, it may make sense to find a broker who will do all the work for you for a fixed fee. That includes tracking the analyst estimates, screening the stocks, and rebalancing the accounts five-to-eight times per month. For PARE-5, our broker handles everything and charges us a flat fee.

Second, while PARE-5 has absolutely trounced the three SWA strategies as well as the S&P 500 index over the past two years, this advantage is somewhat diminished over the long-term assuming the money is held in a taxable account. For that reason, much of the money we’ve invested in PARE-5 resides in 401K and IRA accounts; long-term, the tax advantages of the three SWA strategies can still make them appealing for accounts that are not tax-advantaged.

Give It a Try This Month. Since PARE-5 requires multiple weekly updates and tends to generate large profits quickly, we decided to offer it to Strategic Wealth Advisor subscribers as an add-on subscription for $99 per month. Simply click here to get started.

If you want to get the benefits of PARE-5 with minimal effort and fees, call my office at (800) 776-1910. They’ll give you contact information on how you can execute the strategy with minimal hassle and cost.